A key objective of workers’ compensation programs is to provide adequate compensation for lost earnings to people who experience work-related injury or illness.

A workplace injury or illness can lead to lower post-injury earnings for several reasons, including physical impairment of the worker, disruption of career progression/seniority, a weakened relationship with the employer, and the stigma that may be attached to injured workers.

In this Issue Briefing, we outline ways of examining the adequacy of workers’ compensation earnings replacement benefits. We then present key findings of recent research at the Institute for Work & Health (Tompa et al., 2010) that measured the adequacy of earnings replacement benefits for permanently disabled workers under three workers’ compensation benefit regimes: two in Ontario, before and after the 1990 change in the system, and one in British Columbia that was in place in the 1980s and 1990s.

Conceptual approaches to assessing benefits adequacy

There are several ways that the adequacy of workers’ compensation benefits might be measured. There are two key issues: how to measure lost earnings and how to define the replacement rate — the degree to which the provision of benefits compensates for earnings loss.

Measuring lost earnings

Regarding the first issue, one approach is to compare a worker’s earnings after the date of injury with earnings prior to the injury. This has the advantage of simplicity: if the earnings data are available (and can be linked to compensation claims data), it is straightforward to calculate the ratio of post-injury earnings per year for each year after injury to earnings in the year prior to injury. Ideally this would be done over a lengthy period after injury to capture both short-term and medium- to long-term impacts.

However, this approach has an important limitation: many things may affect the earnings of an individual over time, other than an injury, so it is difficult to determine the specific impact of the injury. Examples of these other influences include: accumulated work experience (which can be affected by work injury, but also affects earnings in the absence of work injury), the acquisition of new skills and knowledge, and labour market conditions. These influences may vary with the characteristics of the worker, such as age and gender. For example, a worker who is injured at a very young age might have had a low pre-injury wage rate, but the expectation of a much higher wage rate as they gained experience and knowledge. In such a case, comparison of post- to pre-injury earnings would understate the earnings loss.

Several researchers in the United States have addressed this problem by constructing comparison or control groups composed of workers with similar earnings to the injured worker prior to the date of injury. Examples of these studies are as follows:

- Biddle (1998) linked accepted workers’ compensation claims filed in the state of Washington from July 1993 through June 1994, with earnings data for six quarters (1.5 years) before and 14 quarters (3.5 years) after a work injury occurred. Earnings losses for more seriously injured workers were estimated by comparing their post-injury earnings with those of workers whose injuries did not involve lost work time. Biddle used statistical methods to adjust for worker and labour market characteristics that might explain differences in earnings losses relative to the comparison group.

- Boden and Galizzi (1999) compared the post-injury earnings of various categories of workers’ compensation claimants in Wisconsin with those of a comparison group of workers who received benefits for only 7-10 days. The claimants had injuries occurring between April 1, 1989 and September 30, 1990. Boden and Galizzi assumed that earnings losses for the comparison group occurred only during the brief period of temporary benefits. Similar to Biddle’s approach, they also used statistical methods to control for other factors (personal, employer and labour market characteristics) that might explain differences in earnings losses relative to the comparison group. They then estimated what the earnings of the injured workers would have been, if they had been in the comparison group, and compared their actual post-injury earnings with these figures.

- Reville (1999) compared the post-injury earnings of permanent partial disability claimants (PPD) in California with the earnings of up to 10 uninjured controls (per injured worker), who were employed at the same firm and had similar earnings before the injury date. Injuries occurred during 1991-93. PPD refers to injuries found to have a permanent impact, but that do not prevent the injured person from returning to some form of work. Reville noted that the use of controls from the same firm as the claimant leads to underrepresentation of small firms because they are less likely to have available controls. In this study, Reville did not include workers at self-insured firms, but in a later study Reville et al. (2001b) extended the analysis to such firms, using claims data from 1991-1995. Reville et al. (2001a) conducted a similar analysis for PPD claimants in New Mexico over the period 1994-98.

Defining the replacement rate

A second issue in measuring the adequacy of workers’ compensation benefits is how best to measure the degree to which benefits compensate for lost earnings. Two alternative measures may be considered.

One approach, adopted in all of the U.S.-based studies outlined above, is to measure the proportion of lost earnings that are replaced by workers’ compensation benefits. We refer to this as the loss replacement rate.

For example, suppose we decided to calculate lost earnings by comparing post-injury with pre-injury earnings. Suppose further that pre-injury annual earnings were $50,000, post-injury earnings were $42,000, and workers’ compensation benefits were $4,000. In this case, the loss of earnings is $8,000 per year, and benefits cover half of that loss. The loss replacement rate is 50 per cent.

A similar calculation could be made if we were using control groups to estimate earnings loss. However, instead of calculating the earnings loss by comparing post-injury earnings with pre-injury earnings, the comparison would be with the earnings of the control group after the injury date.

An alternative approach would be to measure the extent to which the combination of post-injury earnings and workers’ compensation benefits replaced the earnings that the worker would have had if not injured. This could be measured using pre-injury or control group earnings. We refer to this as the earnings replacement rate. In the example just described, the sum of earnings and benefits after injury is $46,000.This yields an earnings replacement rate of 92 per cent (46,000 divided by 50,000).

We have four possible ways of measuring the adequacy of workers’ compensation benefits, depending on the decisions about how to measure earnings loss (either comparing with pre-injury earnings, or with control group earnings after injury) and how to define the replacement rate (loss replacement or earnings replacement).

Measuring benefits adequacy in Ontario and British Columbia

In a recent study at the Institute for Work & Health led by Dr. Emile Tompa, all four methods were used to measure the adequacy of wage replacement benefits for permanently disabled workers. Adequacy was measured under the workers’ compensation regimes in Ontario before and after the 1990 change in the system, and the workers’ compensation regime in British Columbia that was in place in the 1980s and 1990s. (Funding for this research was provided by NIOSH Grant #1 R01 OH007900-01A1 and WorkSafeBC Research Secretariat Grant #RS2006-OG05. For a more detailed discussion of the findings summarized here, see Tompa, Scott-Marshall, Fang, and Mustard (2010)).

Our focus in this Issue Briefing is on the results using control groups to measure wage loss, and using earnings replacement as the measure of adequacy. As outlined above, the use of control groups provides a better indication than pre-injury earnings of what claimants would have earned had they not been injured. Earnings replacement provides a better indication than loss replacement of the degree to which the claimant’s earnings are restored.

In addition, there are two different approaches to averaging earnings replacement rates. For an overview of these approaches, see Tompa et al. (2010). Here we report the results using what Tompa et al. refer to as average individual-level replacement rates.

The three programs

All three of these workers’ compensation schemes provided temporary compensation benefits in the early period of a claim. Long-term benefits were provided once a claimant was identified as having a residual impairment after reaching maximum medical recovery. Our focus here is on claimants who were found to have a permanent impairment.

Ontario’s pre-1990 scheme compensated workers with permanent impairments according to the percentage of physical impairment. Benefits were based on 90 per cent of the pre-injury after-tax earnings multiplied by the percentage of impairment.

The scheme in effect in Ontario from January 2, 1990 to Dec. 31, 1997, involved a two-part benefit for long-term or permanent impairments. First, a non-economic loss (NEL) benefit, usually awarded as a lump sum, was based on the worker’s degree of impairment. Second, a future economic loss (FEL) benefit was provided. It was based on replacing 90 per cent of the difference between earnings before injury, and earnings capacity after injury (both figures after taxes). FEL benefits were reviewed at 12, 36 and 60 months post-injury to re-evaluate the calculation of earnings capacity. (As of January 1, 1998, the target changed to 85 per cent of this difference.)

The third program, in place in British Columbia until 2002, considered two approaches to long-term compensation benefits with every claim. One option was a permanent impairment-based benefit, which was 75 per cent of the pre-injury earnings, before taxes, multiplied by the percentage of impairment. The other option was a loss of earnings capacity benefit, which was 75 per cent of the difference between pre-injury earnings and post-injury earnings capacity, both before taxes. The claimant received whichever benefit was higher. This is sometimes referred to as a bifurcated program. (In June 2002, British Columbia moved to a new system based predominantly on degree of impairment, with a small number of claims still receiving loss of earnings capacity benefits. Benefits formation was also changed to 90 per cent of net earnings: before-tax earnings less provincial and federal taxes, and CPP and EI employee deductions.)

The target replacement rate used in the short-term disability program is often used as a test of adequacy. This is the benefit that compensates people who are temporarily off work but then fully recover. For example, the post-1990 Ontario legislation had a target replacement rate of 90 per cent of after-tax pre-injury earnings.

Meeting the data challenge

Studies of the adequacy of workers’ compensation benefits require the research team to link data from workers’ compensation claims to data on the earnings of injured workers (and matched controls) before and after the injury.

Tompa et al. were able to link workers’ compensation data in Ontario and British Columbia with earnings data from Statistics Canada’s Longitudinal Administrative Databank (LAD). This databank contains information on the earnings of a sample of 20 per cent of Canadian tax filers.

Workers’ compensation records for injuries occurring between 1986-1989 and 1990-94 were linked to the LAD data for the pre-1990 and post-1990 Ontario schemes, respectively. For the British Columbia scheme, data from 1990-94 were used. In each case, earnings information was available for at least four years prior to, and at least nine years following, the injury year. The duration of post-injury earnings data in this study goes well beyond what was available in the U.S. studies cited earlier, none of which had earnings data for more than five years after the year of injury.

The characteristics of the claimants were somewhat different between the two Ontario programs and the British Columbia one, particularly with regard to the average degree of assessed physical impairment. For example, in both of the Ontario programs, less than 30 per cent of the claimants were in the “less than 5 per cent” impairment category. Over 60 per cent of the British Columbia claimants were in this category. In all three programs, only a very small share of the claimants had over 50 per cent impairments — one per cent in both Ontario programs, two per cent in B.C. (The methods used to assess the degree of impairment were somewhat different across the three programs.)

Tompa et al. selected up to 10 controls for each claimant linked to the LAD. The selection of controls was based on a number of characteristics, including wage and salary earnings in each of the four years prior to the injury year, gender, age, and province of residence. Most controls had pre-injury labour market earnings within 10 per cent of their claimant counterparts, and the remainder had earnings within 10-20 per cent of their claimant counterparts.

Findings: labour market earnings post-injury

The before-tax earnings of claimants and control groups were compared annually over a nine-year period after the year of injury, for each of five categories of permanent impairment (under 5 per cent; 5-10 per cent; 10-20 per cent; 20-50 per cent; and over 50 per cent), and for each of the three workers’ compensation programs. For the four years prior to the injury year, average earnings of claimants and controls in each impairment category were close to equal, as a result of the matching process.

On average, claimants in each impairment category and across all three compensation programs experienced lower levels of labour market earnings after injury relative to their control counterparts. As expected, those in the higher impairment categories experienced greater earnings losses. Details are shown in Table 1. The findings suggest that, on average, impairment ratings underestimate earnings losses.

| Impairment category | Earnings loss |

|---|---|

| Under 5 per cent | Approx. 20 per cent |

| 5-10 per cent | 30-40 per cent |

| 10-20 per cent | 40-60 per cent |

| 20-50 per cent | 40-70 per cent |

| Greater than 50 per cent | Approx. 80 per cent |

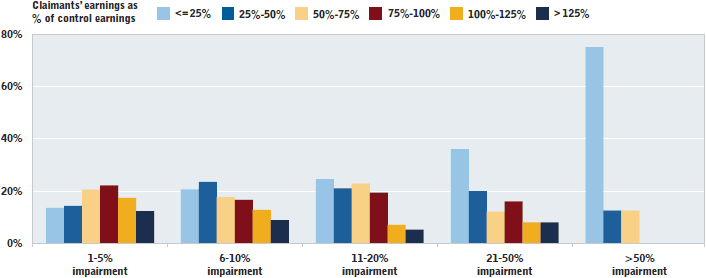

Claimants in the under 5 per cent and in the 50 per cent or greater impairment categories had similar earnings losses in all three of the workers’ compensation programs examined by Tompa et al. Those in the mid-range impairment categories did somewhat better in the B.C. program: their earnings recovery increased over time at a greater pace than claimants in the same category under the two Ontario programs.

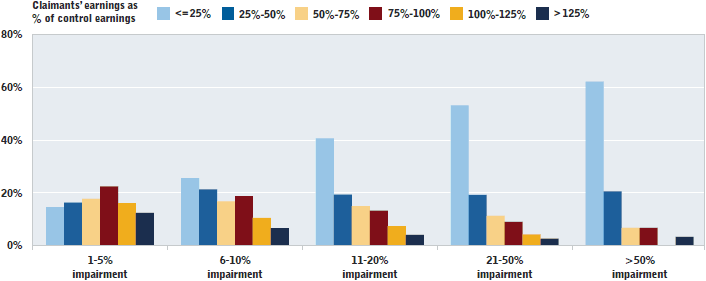

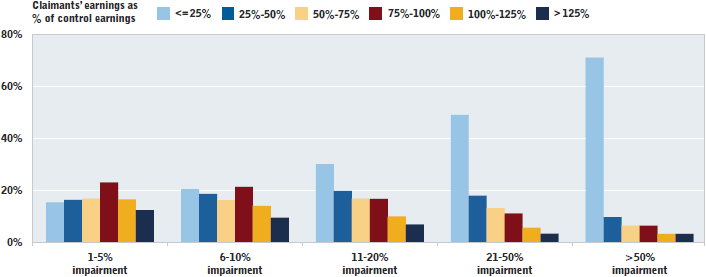

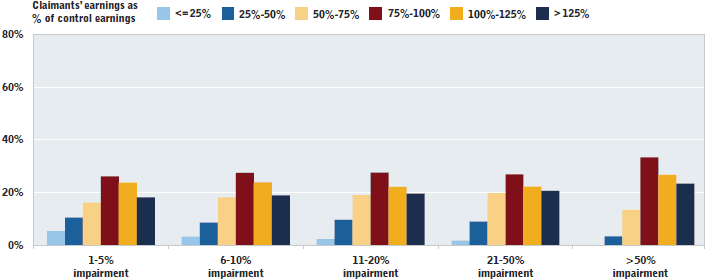

These figures are averages across individuals in each impairment category. To look at how much variation there was in earnings recovery within categories, Tompa et al. examined the share of claimants in each category who experienced earnings losses of less than 25 per cent, 25-50 per cent, 50-75 per cent, and over 75 per cent over the 10-year period, beginning with the year of injury, after taxes. Charts 1, 2, and 3 show the results of this analysis for each of the three workers’ compensation programs. Data for these charts are shown in the tables.

For example, Chart 1, which looks at claimants in Ontario 1986-1989, shows that, for those in the 1-5 per cent impairment category, about half earned, after injury, at least 75 per cent of what control groups earned. In contrast, in the over 50 per cent impairment category, over 60 per cent of claimants earned less than one quarter of the amount the control group earned.

These charts show the high variability in earnings recovery within each category for all three programs. They also show how outcomes are polarized: across all three programs and all categories of impairment, a minority of claimants — usually under 40 per cent — recovered between 25 and 75 per cent of earnings over the 10-year period from the year of injury. In other words, most claimants had either strong or weak earnings recovery. The balance between the two in any category depended, as expected, on the degree of impairment. However, it is noteworthy that even minor impairments resulted in significant earning losses.

In the 1-5 per cent impairment category, almost half had an earnings loss of at least 25 per cent compared with the control group. Reville (1999) reported a similar finding in his study of workers’ compensation in California: significant earnings losses of close to 30 per cent occurred even for those with the disability ratings of 1-10 per cent.

To examine earnings variability in the labour market generally, the research team selected one member of each control group and compared the earnings of the selected controls over the 10-year period with those of the rest of their control groups. As expected, a higher percentage of the controls than claimants had high (over 75 per cent) earnings ratios and a smaller percentage of controls than claimants low (under 25 per cent) earnings ratios. As was the case for claimants, a minority of the selected controls had earnings ratios between 25 and 75 per cent. These findings suggest that much of the variability in the post-injury earnings of claimants is inherent in the labour market.

Findings: comparison of workers’ compensation earnings replacement rates

Tompa et al. calculated earnings replacement rates by first adding after-tax earnings and workers’ compensation benefits. This sum was compared with the earnings of the control groups over the 10-year period beginning with the year of injury. This calculation was done for each of the three workers’ compensation schemes that were examined, by impairment category. The results are shown in Table 2.

| Degree of permanent impairment (or NEL rating) | Ontario pre-1990 | Ontario post-1990 | B.C. bifurcated |

|---|---|---|---|

| 1-5% | 98% | 95% | 99% |

| 6-10% | 99% | 99% | 106% |

| 11-20% | 98% | 99% | 113% |

| 21-50% | 102% | 100% | 123% |

| Over 50% | 107% | 112% | 124% |

| Entire sample | 99% | 99% | 104% |

Note: Figures were converted to 1994 constant dollars and a 3 per cent rate was applied to discount earnings and benefits to the accident year.

On average, all three programs achieved a high level of earnings replacement: over 90 per cent in each impairment category. The lower impairment categories had a somewhat lower earnings replacement rate than did the higher impairment categories. The overall average rate was 99 per cent for the two Onjanetario programs and 104 per cent for the BC program. The percentage of claimants in the overall sample that achieved at least a 90 per cent earnings replacement rate was 50 per cent for the pre-1990 Ontario program, 54 per cent for the post-1990 Ontario program, and 60 per cent for the B.C. bifurcated program.

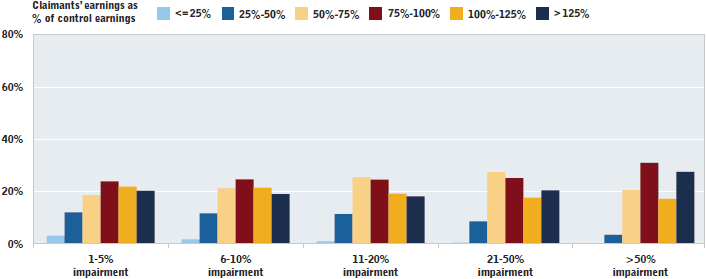

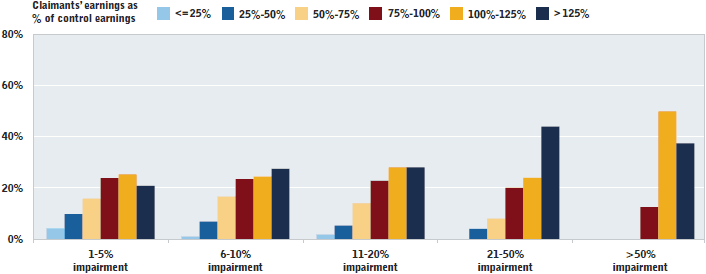

However, it is important to keep in mind that these figures are averages. To examine variation within impairment categories, the research team looked at claimants’ earnings replacement rates using the following breakdown:

- less than 25 per cent of control groups’ after-tax labour market earnings,

- between 25 and 50 per cent of control groups’ earnings,

- between 50 and 75 per cent of control groups’ earnings, and

- over 75 per cent of control groups’ earnings.

The results are shown in Charts 4-6 and in the tables on page 10. Once again, there were substantial variations within impairment categories, but less so than for labour market earnings alone — one effect of the benefits programs was to smooth out the distribution of total earnings (including benefits) within impairment categories.

The results varied by impairment category and across the three workers’ compensation programs. For example, in the pre-1990 Ontario program, in most impairment categories between 60 and 70 per cent of claimants had earnings replacement rates of at least 75 per cent. For those with more severe impairments, in the 50+ per cent category, about 75 per cent acquired this level of replacement. The percentages were higher for the post-1990 Ontario program: near 70 for most categories and over 80 for those with a 50+ per cent impairment rating. The post-1990 Ontario program has slightly more claimants in both the highest and lowest quartiles than the pre-1990 program. The bifurcated program in British Columbia had the highest rate of achieving over 75 per cent earnings replacement. B.C. figures ranged from about 70 per cent for the 1-5 per cent impairment category to 100 per cent for the 50+ per cent impairment category.

Conclusion

The findings of Tompa et al. indicate that for all three of the workers’ compensation programs examined, benefits for permanently disabled claimants were adequate on average. For every category of physical impairment, the average after-tax earnings replacement rate was at least 90 per cent. The average earnings replacement rate was slightly higher in the B.C. program than the two Ontario programs.

However, there is considerable variation in post-injury earnings within each impairment category. There is also some variation in the earnings replacement rates, especially in the lower impairment categories. For levels of physical impairment of 50 per cent or more, about eight in 10 claimants in the two Ontario programs, and all claimants in the B.C. program had an earnings replacement rate of at least 75 per cent. For lower levels of impairment, about 65-70 per cent of claimants in the Ontario programs, and 70-85 per cent in the BC program had an earnings replacement rate of at least 75 per cent. In other words, sizeable numbers in the lower impairment categories had replacement rates below 75 per cent.

Furthermore, the post-injury labour market earnings experience of permanently disabled claimants is polarized, with a minority of claimants having mid-range recovery.

These findings suggest that individual and contextual factors are very important to consider in the workers’ compensation process. Factors such as gender, age, level of impairment, transferable skills, and labour market conditions may all bear on earnings capacity. Particular attention might be paid to the adequacy of earnings replacement among those with low levels of impairment, as earnings losses appear to be sizeable even for those assessed as having impairment levels of 5 per cent or less.

References

- Biddle J. Estimation and analysis of long term wage losses and wage replacement rates of Washington State workers’ compensation claimants. Working Paper. Olympia, WA: Washington State Workers’ Compensation System; 1998.

- Boden LJ, Galizzi M. Economic consequences of workplace injuries and illnesses: lost earnings and benefit adequacy. American Journal of Industrial Medicine. 1999; 36(5):487-503.

- Reville RT. The impact of a disabling workplace injury on labor force participation and earnings. In: Haltiwanger JC, Lane JI, Spletzer JR, Theeuwes JJM, Troske KR, editors. The Creation and Analysis of Employer-Employee Matched Data (Contributions to Economic Analysis). Amsterdam: North Holland; 1999.Reville RT,

- Boden LJ, Biddle J, Mardesich C. An evaluation of New Mexico workers’ compensation permanent partial disability and return to work. Santa Monica, CA: Rand Institute for Civil Justice; 2001a.

- Reville, RT, Polich S, Seabury S, Giddens E. Permanent disability at private, self-insured firms: a study of earnings loss, replacement, and return to work for workers’ compensation claimants. Santa Monica, CA: Rand Institute for Civil Justice; 2001b.

- Tompa E, Scott-Marshall H, Fang M, Mustard C. Comparative benefits adequacy and equity of three Canadian workers’ compensation programs for long-term disability. Working Paper # 350. Toronto, ON: Institute for Work & Health; 2010.